Give the IRS money.

Zach Gibson/Getty Images

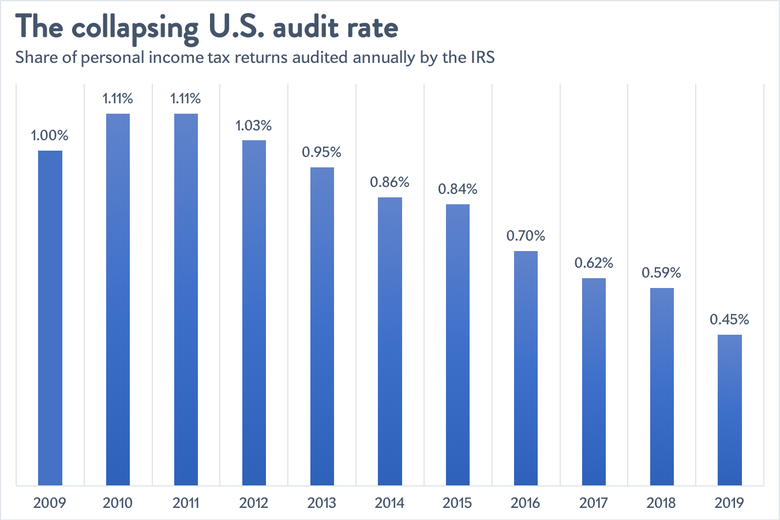

slate.com/_components/slate-paragraph/instances/ck55i39tt002h6elz0cazdbfk@published” data-word-count=”61″ style=”max-width: 100%;”> This week brought yet another stark reminder of how a decade of budget and personnel cuts have crippled the IRS. On Monday, the agency reported that it only managed to audit 0.45 percent of all personal income tax returns in 2019, less than half the share it examined in 2011. The audit rate has now been declining for eight straight years.

Jordan Weissmann/Slate

slate.com/_components/slate-paragraph/instances/ck55leanq00173g60g7n06z25@published” data-word-count=”142″ style=”max-width: 100%;”> The reasons why this has happened are not mysterious. Funding cuts have decimated the IRS staff, which shrank by 22 percent between 2010 and 2018, when it was left with fewer than 9,000 auditors, the lowest number in well over half a century, as ProPublica has pointed out. The agency simply does not have the manpower to hunt down and catch tax cheats. It also has devoted more of the resources it does have to auditing low-income Americans who might have made mistakes filing for the Earned Income Tax Credit, mostly because that’s cheaper and easier to do than scrutinizing the returns of the rich. The share of tax filers with more than $10 million in income who faced an audit has fallen from about 30 percent in 2011 to 6.6 percent in 2018, the latest year for which we have data.

slate.com/_components/slate-paragraph/instances/ck55rm1yz000b3g60cue9g6c6@published” data-word-count=”96″ style=”max-width: 100%;”> Why has the IRS faced budget cuts? Because Republicans in Congress demanded them. Conservatives have demonized the agency for decades, and during the Obama administration they used a series of inflated controversies as excuses to slash its funding. They accused the IRS of singling out conservative nonprofits for harassment (which turned out to be false). They criticized it for spending too much on sending staff to conferences (even after the administration cut down on the expenses). And they attacked the agency for its role in implementing the Affordable Care Act—which is to say, doing its job.

slate.com/_components/slate-paragraph/instances/ck55mfwxy001r3g60hhx6zuhy@published” data-word-count=”174″ style=”max-width: 100%;”> The Trump administration did sign a modest increase in the IRS’s budget into law for this year. But the consequences of putting the IRS on a starvation diet are already here. Every single year, the federal government fails to collect an enormous amount of revenue that Americans legally owe. This vast budget hole is known as the tax gap; according to the IRS’s most recent estimates, which are sadly a bit out of date, it amounted to $381 billion annually between 2011 and 2013. In a paper last year, former Treasury Secretary Larry Summers and University of Pennsylvania law professor Natasha Sarin estimated that $630 billion would slip through the government’s fingers this year. But I suspect their ballpark figure might even be too low; they arrived at it by taking the old IRS estimate, and adjusting it for income growth and inflation. Given how the IRS has been decimated, it seems reasonable to suspect that the rate of tax avoidance is higher now than it was at the start of the previous decade.

slate.com/_components/slate-paragraph/instances/ck55n85t000293g60xm50xlqo@published” data-word-count=”62″ style=”max-width: 100%;”> But just for argument’s sake, let’s assume that $630 billion is accurate. How much money is that? Well, it’s more than the federal government spent on Medicaid in 2019 ($409 billion), and almost as much as it spent on Medicare ($648 billion). It is, in other words, an enormous amount of revenue that the United States is simply leaving on the table.

slate.com/_components/slate-paragraph/instances/ck55nkdc7002g3g60w1sogdxg@published” data-word-count=”74″ style=”max-width: 100%;”> Closing even a small portion of the tax gap could pay for some the left’s most ambitious policy goals. Collecting an extra $150 billion per year, or less than one-quarter of the shortfall, would likely cover the tab for both universal pre-K and tuition-free college1, with plenty left over for other priorities. Alternatively, you could pay for a generous universal child allowance while roughly doubling government spending on health insurance subsidies for Obamacare coverage.

slate.com/_components/slate-paragraph/instances/ck55nz9qv002n3g60eh91l2rt@published” data-word-count=”77″ style=”max-width: 100%;”> Sen. Elizabeth Warren has said that, as president, she would make rebuilding the IRS a priority. But it should be a priority for every single Democrat running for president. It’s both a matter of fairness—people, especially the rich, shouldn’t be allowed to skip out on their tax obligations—and potentially a way to finance major spending programs without actually raising tax rates. The government can pay for nice things—lots of them—just by collecting the money it’s already owed.

1 The Childcare for Working Families Act, which would guarantee universal pre-K and provide subsidized child care for more working class families, should cost $700 billion over a decade, or $70 billion per year, according to the Center for American Progress. Meanwhile, public colleges and universities currently earn $79 billion annually in tuition revenue from their undergraduate and graduate programs combined (the Department of Education’s data does not break out undergraduate tuition on its own, unfortunately). So it seems safe to say that $150 billion annually could pay for both.