Moneybox

Oct. 16, 2017, 5:50 PM

compote.slate.com/images/62e96574-f283-46d4-ac29-d72156509692.jpeg?width=780&height=520&rect=4475×2983&offset=25×0 2x” class=”” style=”max-width: 100%; margin: 0.5em auto; display: block; height: auto;” src=”cid:”>

compote.slate.com/images/62e96574-f283-46d4-ac29-d72156509692.jpeg?width=780&height=520&rect=4475×2983&offset=25×0 2x” class=”” style=”max-width: 100%; margin: 0.5em auto; display: block; height: auto;” src=”cid:”> Here’s a winning idea for you.

MANDEL NGAN/Getty Images

slate.com/components/slate-paragraph/instances/cj8uehk58007kqtl2n0n12yb7@published” data-word-count=”62″ style=”max-width: 100%;”> The Trump administration says its plan for sweeping business-tax cuts is really designed to help workers. To bolster those claims, the White House’s Council of Economic Advisers released a short analysis Monday suggesting that the president’s proposal to lower the top corporate rate from 35 percent to 20 percent would raise the average household income anywhere from $4,000 to $9,000 a year.

slate.com/components/slate-paragraph/instances/cj8uigw6l00003k5v1p4qhakz@published” data-word-count=”33″ style=”max-width: 100%;”> The argument, in brief, is that letting Walmart and General Motors keep more of their profits will lead them to invest more in the U.S., leading to more and better-paying jobs for workers.

slate.com/components/slate-paragraph/instances/cj8uioxgf00043k5vrkhhdmwp@published” data-word-count=”98″ style=”max-width: 100%;”> There are lots of reasons to doubt these sunny forecasts, from the fact that they rely on studies that have been pretty harshly criticized in the past to the fact that corporate profits have been extremely high for years now, interest rates have been extremely low, and yet we’ve seen neither a boom in worker pay nor corporate investment. However, the document got me thinking: What if, instead of relying on the magic of corporate cuts trickling down, Trump just spent the same amount of money cutting every family a yearly check? How much could we all get?

slate.com/components/slate-paragraph/instances/cj8uityp200063k5vk6dcsfy1@published” data-word-count=”23″ style=”max-width: 100%;”> After spending a little quality time in Microsoft Excel, I’d say it’s somewhere the ballpark of $1,350 per household, or $1,000 per worker.*

slate.com/components/slate-paragraph/instances/cj8uizcnk00083k5vhwirg4kv@published” data-word-count=”5″ style=”max-width: 100%;”> Here’s how I get there.

slate.com/components/slate-paragraph/instances/cj8ujbpwe000c3k5vm9padwt2@published” data-word-count=”64″ style=”max-width: 100%;”> According to the Tax Policy Center, Trump’s corporate rate cut would cost the government $1.989 trillion over the next decade, or an average of about $199 billion per year. That’s our spending limit. Last year, there were about 125,819 households in the U.S., according to the Census Bureau. Do a little division, and we arrive at a very rough first-cut estimate of $1,582 each.

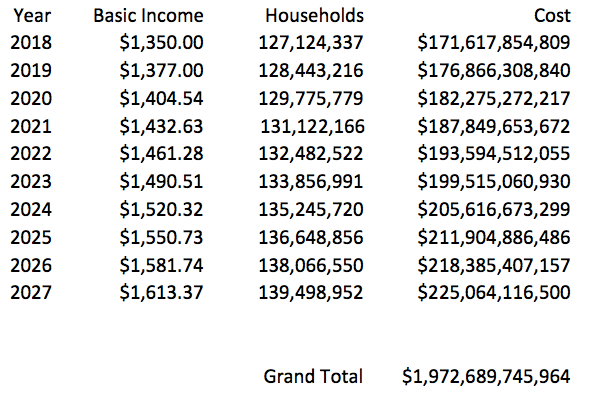

slate.com/components/slate-paragraph/instances/cj8ujkiiw000f3k5vhc018q2k@published” data-word-count=”88″ style=”max-width: 100%;”> Of course, if you want to send families a check that maintains its value over time, you need to factor in population growth and inflation, too. For estimates of the former, I relied on Harvard’s Joint Center for Housing Studies and the Congressional Budget Office, which have both project that the number of U.S. households should grow by roughly 1 percent annually in the coming years. For inflation, I stuck with the Federal Reserve’s target rate of 2 percent (which, frankly, we haven’t even been able to hit).

slate.com/components/slate-paragraph/instances/cj8ujrbfh000h3k5vhbfnfsf6@published” data-word-count=”45″ style=”max-width: 100%;”> So what kind of basic income can you get for the cost of Trump’s corporate cut? If you sent each household a $1,350 check starting 2018 and indexed it to grow at 2 percent annually, the program would cost $1.972 trillion. We’re just under budget.

compote.slate.com/images/ebc824c4-f46a-4e3e-92fa-cac42f068fa3.png?width=780&height=520&rect=589×393&offset=0x14 2x” alt=”How much trump could send to families for the cost of his corporate tax cut” class=”” src=”cid:” style=”max-width: 100%; margin: 0.5em auto; display: block; height: auto;”>

compote.slate.com/images/ebc824c4-f46a-4e3e-92fa-cac42f068fa3.png?width=780&height=520&rect=589×393&offset=0x14 2x” alt=”How much trump could send to families for the cost of his corporate tax cut” class=”” src=”cid:” style=”max-width: 100%; margin: 0.5em auto; display: block; height: auto;”> Source: Author’s calculations, based on household growth projections from the Congressional Budget Office and Harvard’s Joint Center for Housing Studies

slate.com/components/slate-paragraph/instances/cj8uiommc00023k5v3pqc81hm@published” data-word-count=”43″ style=”max-width: 100%;”> Of course, $1,350 is less than the $4,000 Trump’s economic advisers have promised families. But mailing each household a check from the Treasury guarantees them money in their pocket. Cutting corporate taxes, on the other hand, mostly just guarantees more cash for JPMorgan.

slate.com/components/slate-paragraph/instances/cj8umo8aw000l3k5vcfb9050e@published” data-word-count=”84″ style=”max-width: 100%;”> So far, I’ve done the math here in terms of households, because it’s easy to compare with the Trump administration’s (quite optimistic) predictions. But nobody would actually design a policy that distributed money evenly among households, which are merely statistical units that the census defines as a group of people living together in a home who may or may not be related. It would mean sending the same amount of dough to a pair of roommates in Brooklyn as a six-person family in Utah.

slate.com/components/slate-paragraph/instances/cj8unn50f000p3k5vimv28c6u@published” data-word-count=”11″ style=”max-width: 100%;”> What if we imagined cutting a check to each worker, instead?

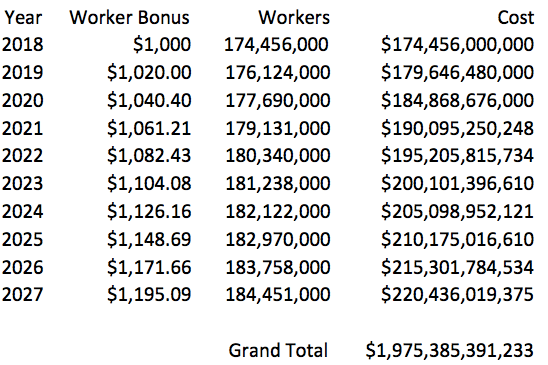

slate.com/components/slate-paragraph/instances/cj8uk63e9000j3k5vmncbk4qt@published” data-word-count=”100″ style=”max-width: 100%;”> Based on the Social Security Administration’s projections about the future size of the U.S. workforce, a $1,000 bonus for each U.S. wage-earner, indexed for 2 percent inflation, should cost just $1.975 trillion over a decade—again, slightly less than Trump’s corporate tax cut. That tax credit/rebate/yearly envelope stuffed full of dead presidents would go to every single American with income covered by Social Security; if you only wanted to cover people who worked most or all of the year, you could offer a bigger payment to fewer individuals. But the policy would reward dual-earner households with twice the money, or $2,000.

compote.slate.com/images/d6c2509d-ae73-4bf0-b790-be4906a4fada.png?width=780&height=520&rect=548×365&offset=3×0 2x” alt=”How much Trump could spend on workers if he skipped the corporate tax cuts.” class=”” src=”cid:” style=”max-width: 100%; margin: 0.5em auto; display: block; height: auto;”>

compote.slate.com/images/d6c2509d-ae73-4bf0-b790-be4906a4fada.png?width=780&height=520&rect=548×365&offset=3×0 2x” alt=”How much Trump could spend on workers if he skipped the corporate tax cuts.” class=”” src=”cid:” style=”max-width: 100%; margin: 0.5em auto; display: block; height: auto;”> Source: Author’s calculations, based on workforce growth projections from the Social Security Administration’s OASDI Trustees Report.

slate.com/components/slate-paragraph/instances/cj8uo0uju000s3k5v5hba5inz@published” data-word-count=”42″ style=”max-width: 100%;”> But again, you could also just light some incense, pray to the great divine, and hope tax cuts for Walmart deliver thousands of dollars more each year in take-home pay for the men and women stocking their aisles. Which would you pick?

compote.slate.com/images/58b109fd-bb0e-41b9-9d0e-153b5323928d.png?width=780&height=520&rect=1352×901&offset=0x0 2x” alt=”What if instead of cutting corporate taxes, Trump cut checks to families?” class=”” src=”cid:” style=”max-width: 100%; margin: 0.5em auto; display: block; height: auto;”>

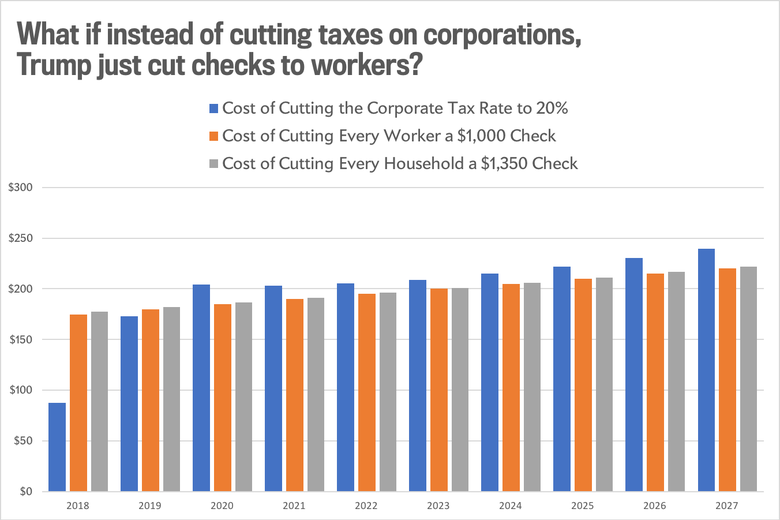

compote.slate.com/images/58b109fd-bb0e-41b9-9d0e-153b5323928d.png?width=780&height=520&rect=1352×901&offset=0x0 2x” alt=”What if instead of cutting corporate taxes, Trump cut checks to families?” class=”” src=”cid:” style=”max-width: 100%; margin: 0.5em auto; display: block; height: auto;”> Checks to workers and households are indexed to increase in value by 2 percent each year after 2018 in order to keep up with inflation

Source: Author’s calculations, based on household growth projections from Harvard University Joint Center for Housing Studies and the Congressional Budget Office, and workforce growth projections from the Social Security Administration’s OASDI Trustees report.

slate.com/components/slate-paragraph/instances/cj8uq7yq500063k5wqszvxbl9@published” data-word-count=”51″ style=”max-width: 100%;”> *Correction, Oct. 16: Due to a spreadsheet error, this post originally stated that we could send a $1,010 check to each worker for the cost of Trump’s tax cut. The extra $10 would put such a policy slightly over budget. The tables and chart have been updated to reflect the correction.