The Congressional Budget Office said Tuesday that health insurance premiums would rise and the federal deficit would increase if President Trump cuts off payments to insurers that help lower medical costs for millions of people.

These payments, which he calls “bailouts for insurance companies,” are one of three main ways that the federal government helps low-income consumers afford health insurance.

The federal government

helps

states expand Medicaid

pays

insurers to lower out-of-

pocket costs

subsidizes

insurance premiums

to help low-income people afford health insurance

Stopping the payments would actually hurt taxpayers and some middle-income Americans who don’t get help from the federal government to pay their premiums.

In 2017, the government made about $7 billion in payments to insurers, which helped about 5.9 million low-income Americans who might otherwise have found medical care unaffordable.

Mr. Trump has repeatedly threatened to cut off the payments, a move that is part of a strategy to “let Obamacare implode.” It is one of several things the Trump administration could do to undermine the Affordable Care Act.

Here’s what would happen if Mr. Trump halts the payments.

1. Premiums would spike.

Insurance premiums for the most popular “silver” plans would be 20 percent higher in 2018 and 25 percent higher by 2020 if the payments are stopped at the end of 2017, according to the budget office.

Because the Affordable Care Act requires that certain low-income customers receive the discounts on out-of-pocket costs, called cost-sharing reductions, insurers would have to offer them even if Mr. Trump halts the payments.

Many insurers have said they would raise premiums to make up for that loss in federal funding. A previous analysis by the Henry J. Kaiser Family Foundation also found that premiums in the “silver” plans could increase by about 19 percent.

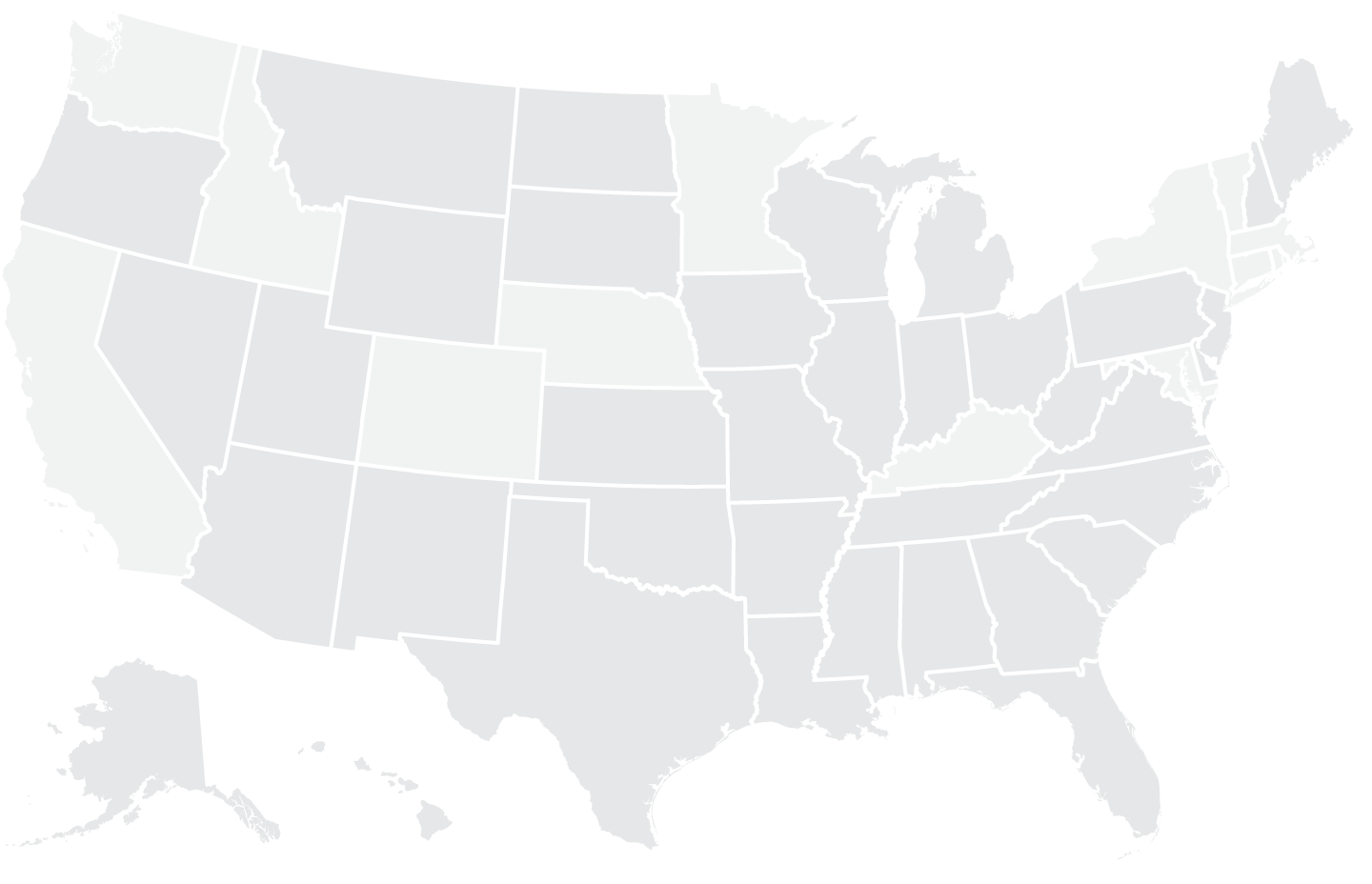

Estimated premium increases in

states that use federal marketplaces

Source: Kaiser Family Foundation

Low-income customers who receive tax credits from the government to help pay for premiums would not experience price increases because subsidies for premiums would also rise under the current health law, essentially covering any premium increase for those who get the full subsidies.

Middle-income customers who are also eligible for premium help would see their subsidies go up, and they may be able to get a free plan with a high deductible or afford a plan with a much lower one.

People who earn too much to qualify for subsidies, however, would end up paying more if they chose the “silver” plan, though they could buy another plan. The budget office thought that insurers would load the price increases onto only the “silver” plan, which is where the cost-sharing reductions apply.

A recent compilation of proposed insurance prices by Kaiser showed that several insurers are already planning higher premiums next year because of uncertainty over whether the cost-sharing reductions will continue.

Requested rate increase due to

uncertainty over cost-sharing reductions

State

Insurer

“Uncertainty” increase

Idaho

PacificSource Health Plans

23%

SelectHealth

20%

Mountain Health CO-OP

17%

Tenn.

Oscar Insurance

17%

Cigna

14%

BlueCross BlueShield of Tennessee

14%

Del.

Highmark Blue Cross Blue Shield Delaware

13%

Wash.

Premera Blue Cross

3%

LifeWise Health Plan of Washington

2%

Source: Kaiser Family Foundation

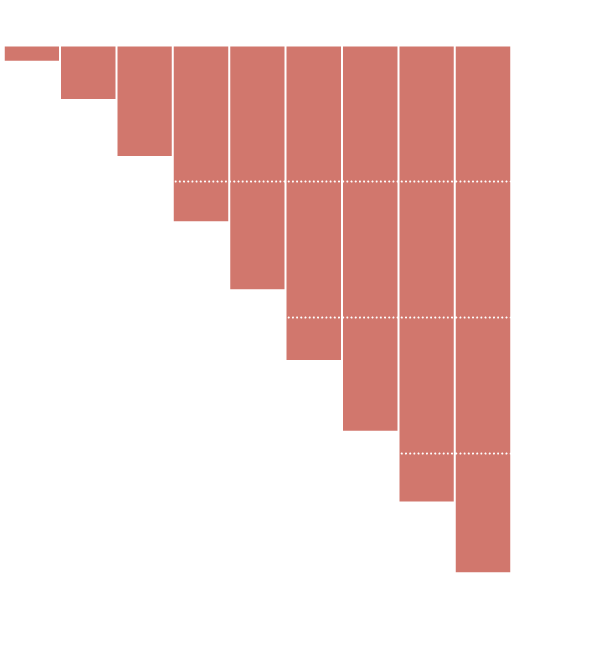

2. The federal deficit would soar.

By spending more to help consumers pay their premiums, the government would end up spending more, leaving taxpayers to pick up the bill.

Cumulative federal deficit

–$194 billion

over 10 years, in 2026

Source: Congressional Budget Office

The budget office estimates the federal deficit would rise by $194 billion over the next decade.

“The average amount of subsidy per person would be greater, and more people would receive subsidies in most years,” the report says.

3. Some insurers might initially

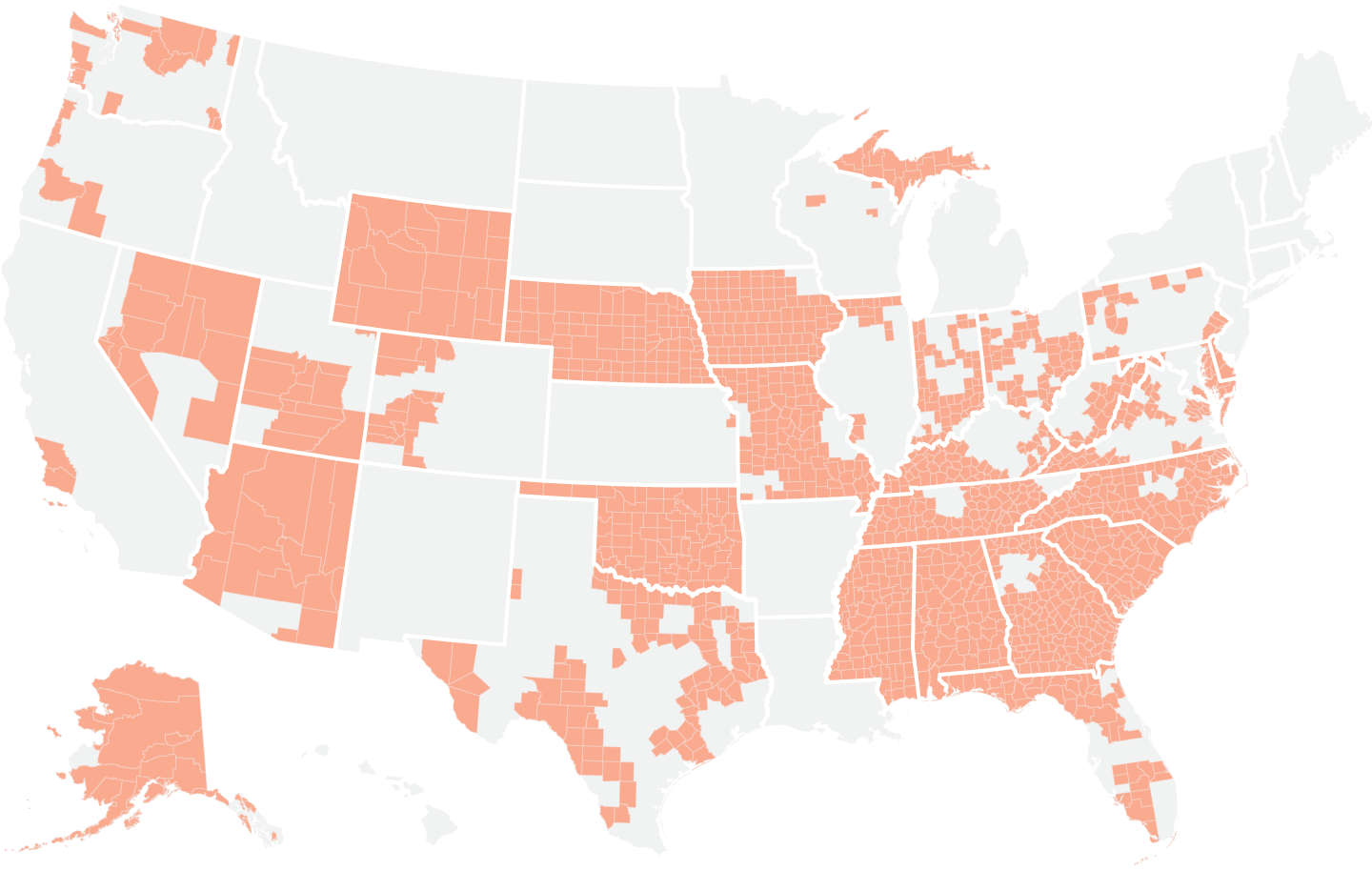

exit, but would likely return.The C.B.O. said that about five percent of Americans would have no insurers to choose from in the individual market next year. But by 2020, the C.B.O. expects more insurers to participate, so almost everyone who wants to would be able to buy health insurance on the federal marketplace.

But experts have worried that insurers could exit the market entirely if they think that Mr. Trump’s decision to stop the payments is part of a bigger plan to undermine the marketplaces.

“If insurers exit and leave a substantial number of counties bare, that would be tantamount to a collapse and leave people in those areas with no options for obtaining coverage,” said Larry Levitt, a policy expert at the Kaiser Family Foundation.

Counties that could have one or

zero Obamacare carriers next year

Source: Data from the Robert Wood Johnson Foundation as of Aug. 14, 2017.

So far, more than 1,400 counties are expected to be left with just one insurer in the Obamacare marketplaces next year, according to analysis by the Robert Wood Johnson Foundation. If insurers flee these markets, people there could be left with no insurance options next year.

In the short-term, the budget office said that stopping cost-sharing reductions would lead to more chaos, as different insurers react in different ways.

The budget office expects the number of people with health insurance to remain largely unchanged.

notes from the interweb